28 Feb Cash or Deferred 401(k) Plan

Presented by Phil Tisue CEO, TAG Resources LLC

The Basics

Any profit sharing or stock bonus plan that meets certain participation requirements of IRC Sec. 40l{k) can be a cash or deferred plan. An employee can agree to a salary reduction or to defer a bonus which he or she has coming. Tax-exempt entities may also adopt a 40l{k) plan.

How It Works

- Employee has the option of taking cash or having it paid to the trust for retirement. This is equivalent to a tax-deductible employee contribution. However, employee deferrals are subject to FICA, medicare and FUTA payroll taxes, with applicable payments from both the employer and employee.

- Any additional employer contributions are tax deductible.

- Employer contributions, if any, are not taxed currently to the employee.

- Earnings accumulate income tax-deferred. • Distributions are generally taxed as ordinary income; they may be eligible for 10-year income averaging,1 or, at retirement from the current employer, rolled over to a traditional or a Roth IRA, or to another employer plan if that plan accepts rollovers.

Two Types of Plans

Salary reduction: An employee can agree to a salary reduction, e.g., 10% of compensation, which the employer then pays to the retirement plan trust. It is deductible to the employer but is not included in the employee’s gross income.

- Cash or deferred: The employer can decide to pay a bonus and give the employees the following choices.

- Take it as cash.

- Defer it to the trust.

- Take part and defer the rest.

Those born before 1936 may be able to elect lO year averaging or capital gain treatment.

Deposit of 401(k) Salary Deferrals

The Department of Labor (DOL) has conducted many 40l(k) plan audits. The deposit rule originally issued by the DOL was that “The employer must deposit the funds as soon as practical, but not later than 15 business days following the close of the calendar month during which the deferrals were made.” For years, the DOL enforced the “as soon as practical” portion of this rule and not the “15 business days” part. In February 2008, the DOL proposed a seven business day “safe harbor” for plans with fewer than 100 participants. If the 40l(k) contributions’and participant loan payments are remitted to the plan no later than the seventh business day following withholding, the DOL will consider this a timely deposit. While this is still a proposed regulation, the DOL has stated that small employers may rely on this rule.1 Plans with more than 100 participants are still subject to the old standard, as-soon-aspractical and not later than 15 business days after the month the deferrals were made. In most situations, however, the DOL expects deposits to be made no later than 2-3 days after the payroll date, regardless of the as-soon-as practical/IS day deadline.

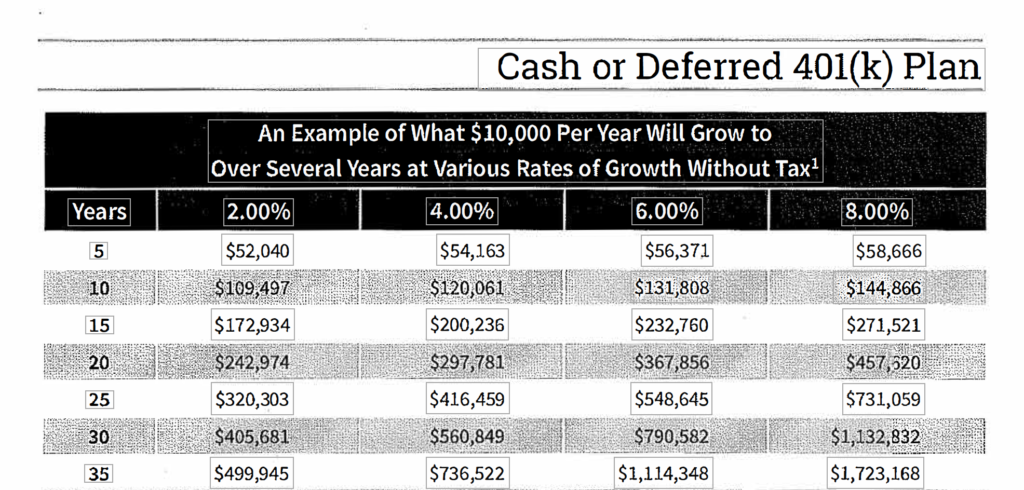

How Much Will There Be at Retirement?

The risk of good or bad investment returns rests upon the employee. The amount available at retirement will depend upon three factors:

- The frequency and amount of contributions.

- The number of years until retirement.

- The investment return.

Additional Considerations

- Maximum annual allocation: Employers may deduct contributions of up to 25% of covered payroll. This amount includes employer contributions and account forfeitures.

- Individual limits: For 2019, the allocation total of employer contributions and employee deferrals to a participant’s account may not exceed the lesser of 100% of compensation or $56,000 per year. An employee’s annual elective contributions to the plan are limited to $19,000. For those age 50 and older, additional “catch-up” contributions of $6,000 may be made.

- Roth 401(k): A 401(k) plan sponsor may modify plan provisions to allow participants the option to contribute to a Roth account. Contributions to a Roth 401(k) are made with after-tax dollars, subject to the same employee elective deferral limits as the plan.

- Investment of plan assets: Plan investments must be diversified and prudent.

Subject to plan provisions, plan assets may be invested in equity products such as

mutual funds, stocks, or debt-free real estate, or in debt investments such as T-Bills or CDs. Life insurance and annuity policies may also be used. If the plan mandates that employee deferrals must be invested in employer stock (or the trustee can direct such an investment), then the maximum that can be invested in employer stock is generally 10.0%. - Typically, participants direct the investment of their own deferrals: They may also direct the investment of employer contributions.

- Parties which are favored: The higher paid, younger employee is favored because he or she has a longer time for funds to accumulate tax-deferred.

- Matching programs: Some employers choose to match each dollar put in by the employee with some multiple, e.g., 50%, 75%, etc. If the employee does not defer, the employer does not make a match.

- Fail-safe contribution: If the non-highly compensated employees do not defer enough relative to what the highly compensated employees want to defer, Treasury Regulations permit the employer to make a contribution sufficient to bring the non highly compensated employees up to the level necessary to support the highly compensated employee’s deferral percentage. This type of contribution must always be fully vested. Highly compensated employees include 5%-or-more owners and those earning more than $125,0001 in the prior year. If the employer so chooses, the plan may include only those earning more than $125,000 who are also among the top paid 20% of employees.

- Salary reductions: Participants must enter into or be deemed to have entered into a salary-reduction agreement permitting a payroll deduction. This must be done prior to being eligible to receive the compensation.

- Withdrawal of funds: Funds can generally be withdrawn in the event of (a) termination of employment; (b} death or disability; or (c) reaching age 59½. If the plan provides, employer contributions may be withdrawn if the funds have accumulated in the plan for at least two years, if an employee has participated in the plan for at least five years.

- Financial hardship: Elective contributions can be withdrawn if the participant has a “financial hardship.” Treasury regulations define this as “immediate and heavy financial need where funds are not reasonably available from other sources.” Safe harbor rules spell out the conditions and requirements for hardship distributions.

- Forfeitures: As participants leave the company and separate from the plan, those less than 100% vested in the employer contribution account forfeit that part of the account in which they are not vested. The nonvested forfeitures may then be allocated to the remaining participants. Those participants who remain in the plan the longest will share in the most forfeitures, or forfeitures may reduce future employer contributions.

- Automatic enrollment arrangement: An employer may adopt an arrangement under which a specified percentage of salary will automatically be contributed to the 401(k) plan for each employee unless an employee chooses to “opt-out” of the system.

- Top-heavy plans: If 60% or more of plan assets are allocated to key employees,1 the employer will be required to contribute up to 3% of compensation to all non-key participants if any key participant defers, and/or receives an employer contribution, up to 3% of his or her compensation. In order to meet top-heavy minimum allocation requirements, employee contributions made by non-key employees are not recognized.2

- Discretionary contributions: In addition to any matching and/or top-heavy contributions, an employer may make discretionary contributions from year to year so long as the allocation among the participants is on a non-discriminatory basis. These contributions may be allocated in several different ways. These contributions can be made to the plan up to the due date of the return plus any extension granted to the employer. Any employer contributions made on a discretionary basis that are not required to maintain the plan qualification may have gradual vesting.

1 This limit applies to 2019. This limit was $120,000 for 2018.

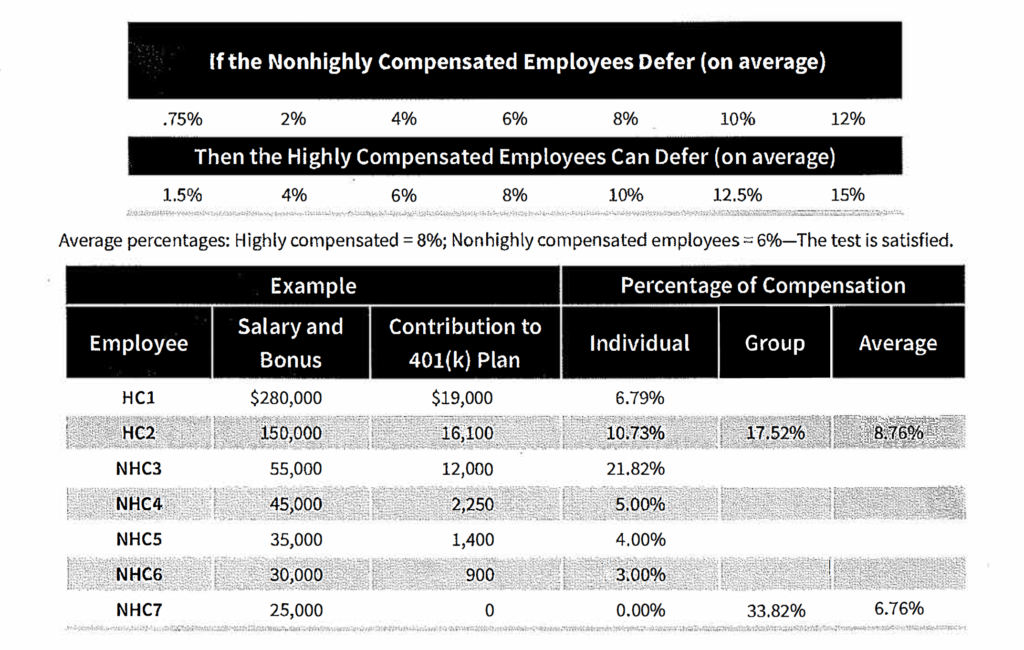

Nondiscrimination Rules

Certain 401(k) plans, generally known as “Safe Harbor” 401(k) plans, automatically pass IRS nondiscrimination tests. 401(k) plans that do not meet one of the IRS safe harbors must use a mathematical test to determine if the plan is discriminatory.

First, all employees eligible to participate are divided into two groups according to their compensation and ownership in the employer. The highly compensated 1 may defer up to two times what the non-highly compensated can for the first 2%. If the non-highly compensated on average defer between 2% and 8%, the highly compensated may contribute an additional 2%. (If more than 8%, then up to 125% of the rate.) In the first year of a 401(k) plan, a 3% deferral rate for non-highly compensated employees may be used if greater than the actual deferral rate. The amounts contributed by the non-highly compensated employees will set the limit on how much the highly compensated can defer. The deferral percentages must be satisfied for the entire year. An excise tax is assessed if excess deferral amounts are not returned within 2½ months after the close of the plan year. Or, instead of returning deferrals, the employer may make a contribution to the non-highly compensated participants.

1 A “key” employee is someone who, at any time during the plan year was: (1) an officer of the employer whose compensation from the employer exceeded $180,000; or (2) a more than 5% owner; or (3) a 1% owner whose compensation from the employer exceeded $150,000. 2 Employer-matching contributions, if any, count toward satisfying the top-heavy requirement. However, if a non-key person does not defer and, hence, not receive a match, the employer would have to make the top-heavy contribution.

If the Non highly Compensated Employees Defer (on average)

In general, a highly compensated participant is one who owns 5% or more of the employer or was paid $125,000 or more (year 2019 limit) in the prior year.

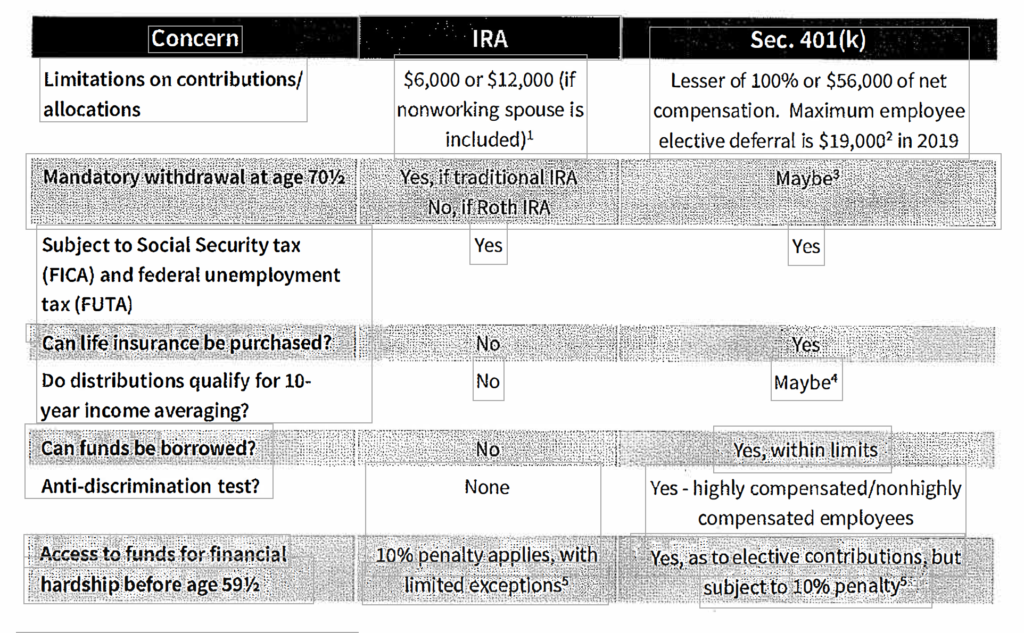

IRA vs. 401(k)

Since most 401{k) plans are funded with employee money, the chart below compares the 401(k) plan to an individual retirement arrangement.

Advantages to Employer

- Employers are not required to make discretionary contributions.

- If the employer does make a discretionary contribution, it is deductible.

- Any employer discretionary contribution is flexible.

- The plan is easily understood by employees.

- An employer matching contribution is a very popular benefit to employees and can be provided at a modest cost.

- The plan can provide employees with permanent life insurance benefits that need not expire nor require costly conversion at retirement age.

- The Plan Trustee can direct plan investments. • Of all the allocation techniques that can be used for employer discretionary contributions, the one best fitting the employer’s objectives can be utilized.

- If former participants do not provide the plan with distribution instructions, the plan may automatically distribute accounts less than $5,000. In the case of a plan that provides for such mandatory distributions, the plan must automatically roll an eligible distribution amount that exceeds $1,000 to a Rollover IRA in the former participant’s name. A plan may allow direct rollovers of less than $1,000.

1 For those aged 50 and older, additional 0catch-up” contributions of $1,000 may be made. 2 For those age 50 and older, additional ucatch-up contributions of $6,000 may be made. 3 Except for more-than-5% owners, payments must begin by April 1 of the later of (a) the year following the year in which the participant reaches age 70½, or (b) the year following the year in which the participant retires. If the employee is a 5%-or more owner, withdrawals must begin by April 1 of the year following the year he or she reaches age 70½. 4 Those born before 1936 may be able to elect 10-year averaging or capital gain treatment. 5 See IRC Sec. 72(t).

Advantages to Employees

- Participant deferrals are with pre-tax dollars. • Any employer contributions are not taxable to participant.

- Participants may be given the right to direct investments. If participants are given the right to “self-direct;’ plan sponsors are required to provide certain standardized investment fee and performance data. This information is intended to aid participants in making better-informed investment choices.

- Federal law allows a qualified plan to establish an “eligible investment advice arrangement” under which individually tailored investment advice is provided to plan participants. Any fees or commissions charged must not vary with the investment options chosen, or else a computer model meeting certain requirements must be used.

- Participants may also have a traditional, deductible IRA (subject to certain income limitations based on filing status), a traditional, nondeductible IRA, or a Roth IRA.

- There is the ability to purchase significant permanent life insurance that is not contingent upon the company group insurance program. Purchase of life insurance will generate taxable income to the employee.

- Younger employees can accumulate a larger fund than with a defined benefit plan. • The forfeited, unvested portion of any employer-generated accounts may be reallocated to the active participants’ accounts.

- Participant may borrow from the plan within certain guidelines if provided for in the plan documents.

- If the plan permits, participants can make hardship withdrawals within the requirements of the plan;1 these may not be rolled over to any IRA.

- The employer may make matching contributions of some amount.

- The employer may be required to make additional contributions to satisfy top heavy and/or discrimination tests.

- ERISA and federal bankruptcy law provide significant protection from creditors to participant accounts or accrued benefits in tax-exempt retirement plans.

Disadvantages to Employer

- Employers may be required to make a variety of mandated contributions to satisfy top-heavy requirements and/or discrimination requirements.

- The more highly paid participants may not be able to make sufficient contributions to build an adequate retirement. This may bring pressure on the employer to provide additional retirement benefits.

- Since a 401(k) plan can be the most complicated type of plan to have, the administration costs will be greater than with other types of plans.

- If the plan fails the discrimination tests, it may have to make refunds to the highly compensated participants, or make a contribution on behalf of non-highly compensated individuals.

- Because there are employee contributions made through payroll, a 40l(k) plan increases the workload of company staff who handle payroll.

- If a plan gives participants the right to direct investments, plan sponsors are obligated to provide participants with standardized investment fee and performance information. Failure to comply with these ERISA requirements may result in a breach of fiduciary duty to plan participants, and the loss of ERISA Section 404(c) protection. In this situation, the plan fiduciaries could be held responsible for the results of the participants’ own investment choices.

Disadvantages to Employees

• There is no guarantee as to future benefits. • The investment risk rests on the participant. • The employer may or may not make discretionary contributions.

No Comments