27 Jan Learning Fiduciary Leadership from a Football Coach

When the Department of Labor (DOL) Fiduciary rule was first unveiled, many financial advisors (FA), broker dealers (BDs), and recordkeepers rushed to re-tool their processes in order to ensure compliance to the hefty liability that came along with the new ruling. Pockets of advisors and BDs realized that the Return on Investment (ROI) accompanying small plans in many cases did not justify the fiduciary risk brought about with the new ruling.

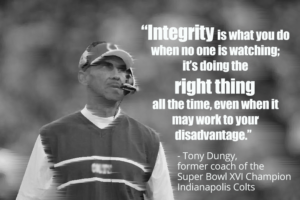

Think of the Fiduciary ruling as a pro-style football offense and you’ve been playing pretty well against it, but now is the time to step up your game and make your 3(16) partner or your TPA do a better job of backing you up. Just ask yourself, “What would Tony Dungy do in this situation?”

TAG Resources is absolutely committed to protecting our clients; our track record has proven that we lead the retirement industry in this arena. Over 65% of 401(k) plans fail a random DoL audit, but over the course of 15 years, a plan has yet to fail an audit when following TAG’s guidance. We place significant resources behind our fiduciary responsibility. We have invested $1.4 million in our signature Bedrock platform in the last two years alone. This proprietary software allows us to police all plan data and serve as independent validation of the recordkeeper’s data, adding another layer of protection unmatched in the industry.

How did TAG lead in this environment? Simply, doing what we always do – telling all FAs, BDs, and other industry experts to send those plans our way. Our plans & processes have always complied with all aspects of the new fiduciary rule, and we are passionate when it comes to taking care of people and plans. We know that our partners, FAs, BDs, and recordkeepers alike, share this same passion. That’s what Tony Dungy would do.

How did TAG lead in this environment? Simply, doing what we always do – telling all FAs, BDs, and other industry experts to send those plans our way. Our plans & processes have always complied with all aspects of the new fiduciary rule, and we are passionate when it comes to taking care of people and plans. We know that our partners, FAs, BDs, and recordkeepers alike, share this same passion. That’s what Tony Dungy would do.

TAG is not the cheapest administrator in the industry: The investment that TAG has placed in our technology and our people make this a virtual guarantee. The manner in which we partner with advisors allows all parties to reap the benefits of these investments: It’s a win-win scenario when it comes to bringing peace of mind to the client.

The newly-elected administration has pledged to reduce regulatory burdens across the board, and indications are this includes portions of the new fiduciary rule. This adds even more uncertainty to that which has plagued this market space for over a year. We, along with our advisors and strategic partners, seek innovative ways to mitigate this uncertainty. When partnering with TAG, you are engaging in a mindset and culture of core values that transcend legislation, not one that is dependent upon one regulation. Reducing administrative burden, managing risk, and protecting clients with integrity — these are principles rooted in integrity, shared by our partners, and guiding forces that we believe will help shape the industry as we move forward to bring a secure retirement for more Americans.

No Comments